Passive income is a type of income that comes from sources that are not actively sought by the holder of the income. Rather, the holder of the passive income is concerned with preserving it for future generations.

If you own a small business and you receive money from customers who buy your products and services, that would be considered passive income.

However, the term passive income can also be used to describe other forms of income such as rental income, royalties, capital gains, and dividends.

The reality of passive income is that it is an uncommon source of income among the general population. To make more money, you need to take financial risks.

However, passive income is different in that it requires you to take fewer risks but provides a higher return. Given below are some key facts about passive income.

What Is Passive Income?

The term passive income is often used in reference to long-term, stable income. However, the income itself is not passive. Rather, the source of the income is considered passive.

The Difference Between Active And Passive Income

As mentioned above, there is a great difference between active and passive income. Active income is that revenue-oriented. It is obtained by earning money for someone else. Active income includes salaries, wages, and other forms of paid work.

However, when it comes to passive income, the word passive is used. The passive income source is a revenue-free activity that is not necessarily connected with work or jobs.

Ways To Create Passive Income

There are a variety of ways to create passive income. One such way is to sell goods and services on a peer-to-peer (P2P) platform. For example, you could offer to sell your products and services for a certain amount of money per day or per week.

Then, you will receive payments from the users who purchase your goods and services. You can also invest in cryptocurrencies or blockchain-based startups.

There are many ways to make money with cryptocurrencies as well as blockchain-based startups. For example, you can invest in a company that is developing the world’s most scalable blockchain network. There are several ways listed below.

Buy An Asset That Earns Passive Income

Another effective way to create passive income is to acquire an asset that already provides you with passive income. For example, if you have a profitable small business and you acquire an additional profitable business, both of your businesses will generate income from the same source passive.

You can also acquire a business that is growing profitably or yours that is not doing well, and then you can sell the assets to fund your new business.

Create An Asset That Earns Passive Income

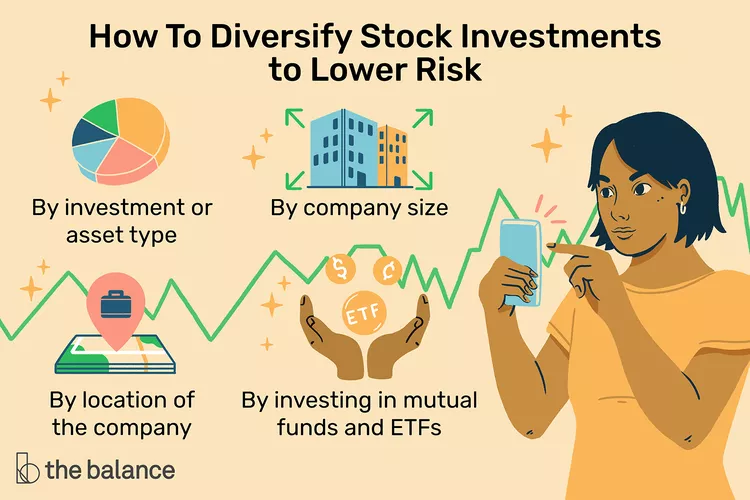

You can also create an asset that will earn passive income, and this is done through either real estate or an investment vehicle such as mutual funds.

For example, you can buy an existing house and then rent out a portion of the house. Alternatively, you can buy a small piece of land and then develop the land into a residential complex.

Additionally, you can also invest in funds such as mutual funds that will provide you with a fixed amount of income for a long period of time.

Rent An Asset That Earns Passive Income

Another way to create passive income is to rent an asset that already generates passive income. For example, if you own a small house, you can rent it out to tenants.

Similarly, if you have an auto repair shop and you rent your equipment to customers who need to have repairs done, that would be considered passive income.

The Bottom Line

The bottom line is that passive income is an option for those who want to avoid the risks and rewards of making money with their own efforts.

It is not the best choice for those who want to make fast and high-profit ventures. Essentially, it is a good option for people who want to save but do not want to give up their day job.